UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT

PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OFProxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑☒

Filed by a Party other than the Registrant ☐o

Check the appropriate box:

| o | ||||

| Preliminary Proxy Statement | |||

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| Definitive Proxy Statement | |||

| Definitive Additional Materials | |||

| o | Soliciting Material under §240.14a-12 |

Popular, Inc. | ||||

|

| |||

| ||||

(Name of Registrant as Specified | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box):

☒ | ||||

| No fee required. | |||

| Fee computed on table below per Exchange Act Rules 14a-6(i) | |||

(1) |

| Title of each class of securities to which transaction applies: | ||

(2) |

| Aggregate number of securities to which transaction applies: | ||

(3) |

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

(4) |

| Proposed maximum aggregate value of transaction: | ||

(5) |

| Total fee paid: | ||

o | ||||

| Fee paid previously with preliminary materials. | |||

o | ||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | ||||

| Amount Previously Paid: | |||

(2) |

| Form, Schedule or Registration Statement No.: | ||

(3) |

| Filing Party: | ||

(4) |

| Date Filed: | ||

DATE AND TIME

Tuesday, May 8, 2018

7, 2019

9:00 a.m. (local time)

PLACE

Popular Center Building

PH Floor

209 Muñoz Rivera Avenue

San Juan, Puerto Rico

RECORD DATE

March 9, 20188, 2019

ITEMS OF BUSINESS

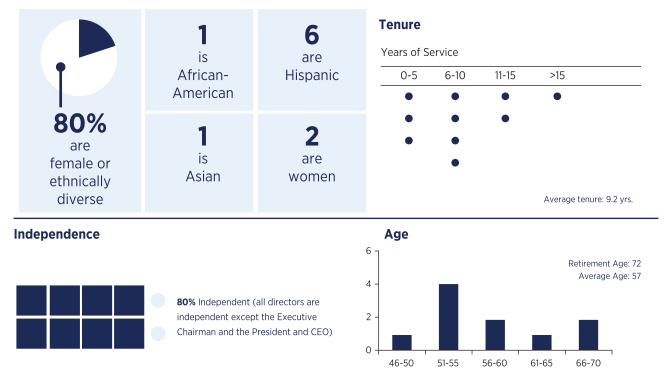

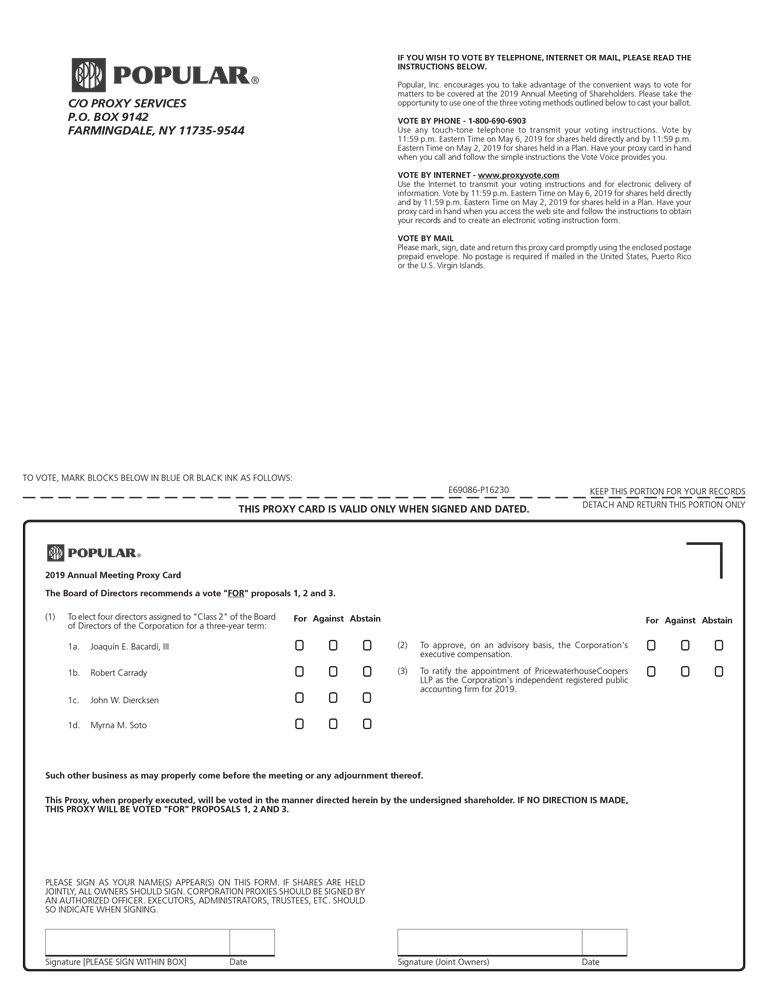

Elect four directors assigned to “Class 1”2” of the Board of Directors for a three-year term;

Authorize and approve an amendment to Article Seventh of our Restated Certificate of Incorporation to provide that directors shall be elected by a majority of the votes cast by shareholders at the annual meeting of shareholders, provided that in contested elections directors shall be elected by a plurality of votes cast;

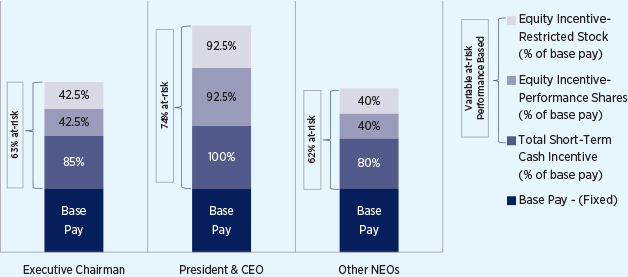

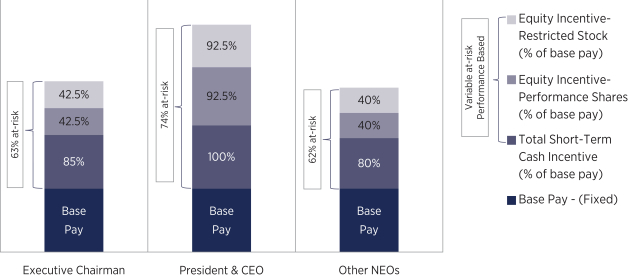

Approve, on an advisory basis, our executive compensation;

Approve the adjournment or postponement of the meeting, if necessary or appropriate, to solicit additional proxies, in the event that there are not sufficient votes at the time of the meeting to approve the proposed amendment to Article Seventh of our Restated Certificate of Incorporation; and

Consider such other business as may be properly brought before the meeting or any adjournments thereof.

In San Juan, Puerto Rico, on March 21, 2018.

20, 2019.

By Order of the Board of Directors,

Javier D. Ferrer

Executive Vice President, Chief Legal Officer and Secretary

HOW TO VOTE

|  |  |  | |||

| ||||||

Only shareholders of record at the close of business on March 9, 2018 are entitled to notice of, and to vote at, the meeting. Each share of common stock is entitled to one vote.

We encourage you to attend the meeting. Your vote is important. Whether or not you plan to attend, please vote as soon as possible so that we may be assured of the presence of a quorum at the meeting.

You may vote online, in person, by telephone or, if you received a paper proxy card in the mail, by mailing the completed proxy card. The instructions on the Notice of Internet Availability of Proxy Materials or your proxy card describe how to use these convenient services.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 8, 2018:

This 2018 Proxy Statement and our Annual Report for the year ended December 31, 2017 are available free of charge atwww.popular.comand www.proxyvote.com.

209 Muñoz Rivera Avenue

San Juan, Puerto Rico 00918

(located on the following page) and visit:

(located on the following page) and visit: